how long does coverage normally remain on a limited-pay life policy

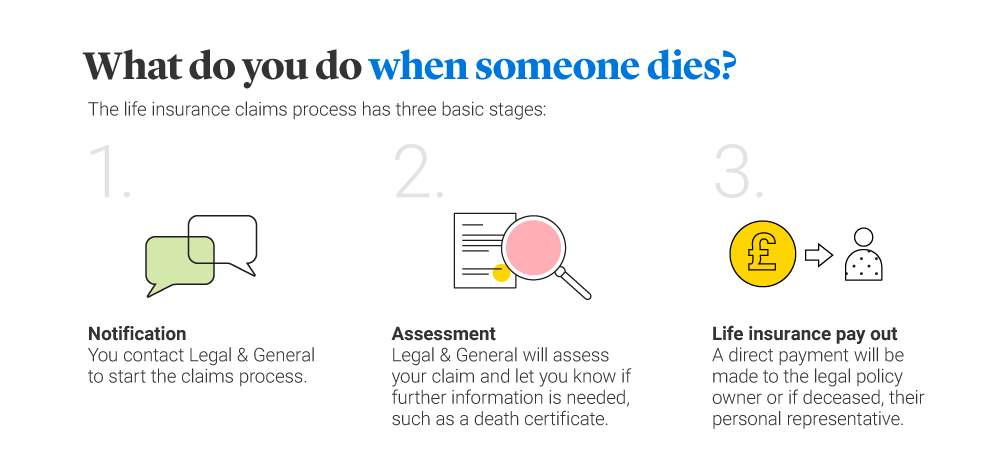

Most insurance companies will issue the death benefit within two weeks of the policyholders death. What type of life insurance gives the greatest amount of coverage for a limited period of time.

New York Life Insurance Review Whole And Universal Life Valuepenguin

Term life insurance coverage lasts for a limited period of time.

. But on average how long does it take for life insurance to be distributed. Age 100 What kind of life policy either pays the face value upon the death. The coverage length on a cash value policy is the time period when the policy endows.

Once the claim is submitted it will be processed and a check can often be sent or deposited into a money-market-like find within 10-14 days. A limited pay policy is whole life insurance that requires premiums only for a specified number of years or to a specified age of the insured. After the 20 years the premiums will increase exponentially.

Paid Until Age 65. How long does the coverage normally remain on a limited-pay life policy. How long does the coverage normally remain on a limited-pay life policy.

As a general rule of thumb fewer years results in a higher annual premium. What kind of premium does a Whole Life policy have. Continue paying Part A deductible if you havent paid the entire amount No coinsurance for first 60 days.

In most cases whole life policies pay a tax-free death benefit to beneficiaries when the insured dies. Most people pay a premium on whole-life their entire lifetime but many will pay it in full within 10-years or 20-years. A Limited-Pay Life policy has.

There are several things that impact how long you can stay on claim and receive long-term disability benefits. Also the shorter the pay period the more faster you will accumulate cash value. The insureds total loan value.

Some pay it with one single premium. The insureds total loan value. In the SNF continue paying the.

Working with a full-time agent will help you secure the proceeds quicker. This article will discuss a few of these things including definitions of disability benefit limitations and the maximum benefit period but it is important to read your long-term disability policy in order to understand your specific coverage. Limited pay policies are sometimes referred to as 10-pay 15-pay or 20-pay life depending upon the number of years premiums are to be paid.

How long does the coverage normally remain on a limited-pay life policy. As long as you pay premiums your beneficiary will receive the benefit amount upon your death. Premiums are payable for as long as there is insurance coverage in force.

Most people buy it for either 1-years 20-years or 30-years. The amount of coverage on a group credit life policy is limited to. If you try to keep term life insurance too long you will pay a.

Annual renewable term This gives you coverage for one year with the option of renewing it each year for a specified duration such as 20 years. With this policy your rates go up every year that you renew and are calculated based on. Premiums are payable for as long as there is insurance coverage in force.

Term Life Insurance- Term is a policy that you decide how long yopu want to keep it when you buy it. If G were to die at age 50 how long would Gs family receive an income. Older people may be restricted to 10- or 20-year terms especially once they reach their 60s and 70s.

A whole life policy provides a set amount of coverage for your entire life. Life Paid-Up at Age 70. That can be anywhere from 20 to 30 years if you plan to support past the age of 18.

Term length limits can also impact how much coverage you get regardless of how much life insurance you need and can afford. If you are thirty years old and purchase a twenty year policy then the premium and life coverage will last until you are 50 years old. This is pretty simple to explain.

Fewer than 60 days have passed since your hospital stay in June so youre in the same benefit period. How long does the coverage normally remain on a limited-pay life policy. This is the main reason that term insurance is far less expensive than whole and universal life insurance.

The investment gains from a universal life policy usually go toward. Which of these would be considered a Limited-Pay Life policy. Assuming you are referring to the proceeds from a death benefit on a life insurance policy the process does not take long.

On term life policies the length of coverage refers to the time period that the premiums are level and guaranteed not to increase. You may have to wait up to 30 days for a payout but you will usually receive it much sooner. For example a 20 year level terms coverage length is 20 years at a set premium.

Coverage however remains in force for the insureds lifetime. Its possible to access that cash value as the funds grow. The amount of coverage on a group credit life policy is limited to.

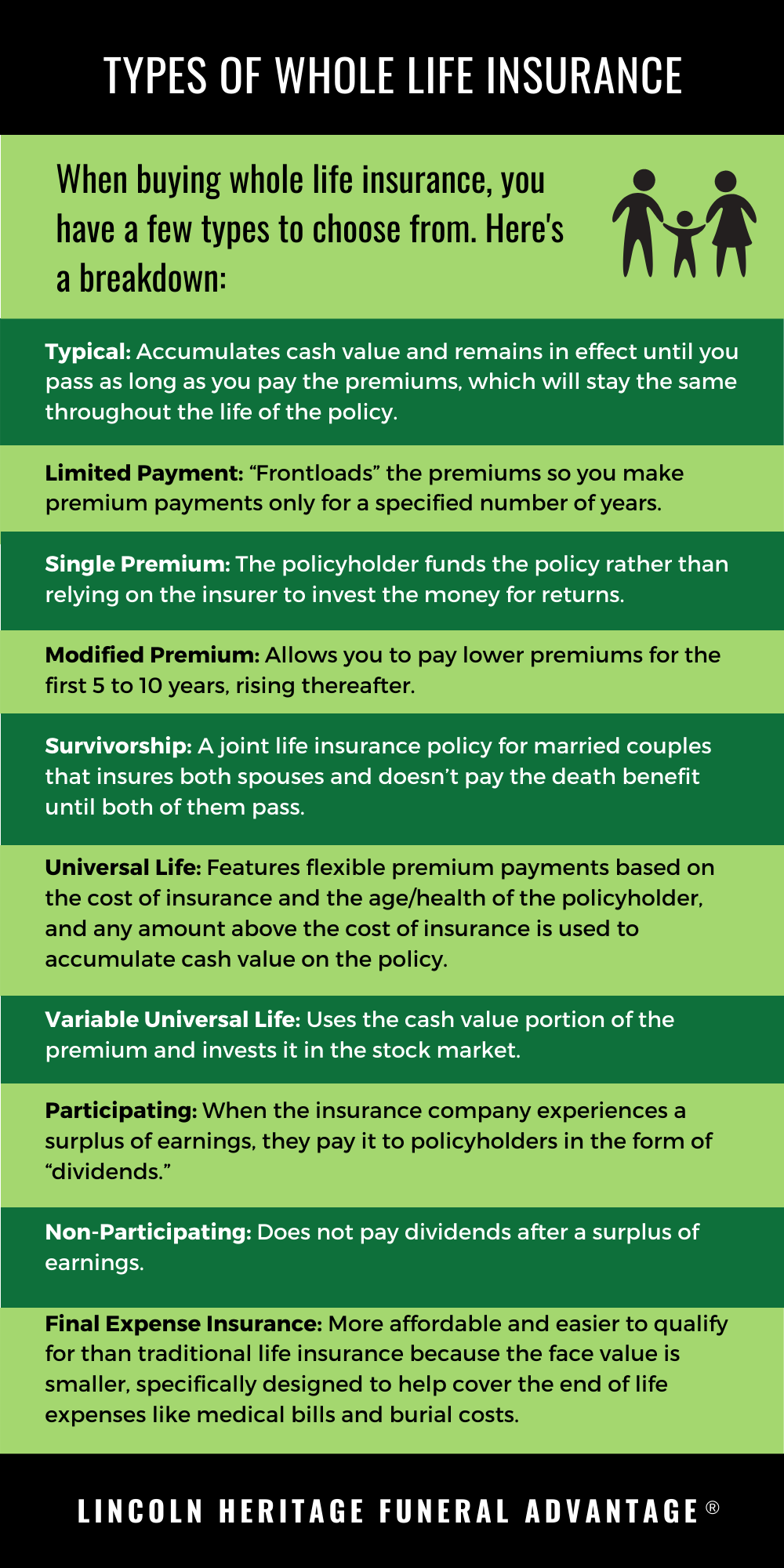

Age 100 20 A term life insurance policy matures upon the insureds death during the term of the policy Decks in Insurance Class 3. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100.

How long does the coverage normally remain on a limited-pay life policy. A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no more premiums due. As mentioned above whole life policies also build up cash value from part of the premium being invested.

Whole Life Insurance How It Works

Funny Competitive Swimming Design Education Is Important But Swimming Is Important Hoodie Pullover Swim Shirt Designs Competitive Swimming Swim Hoodies

Do I Need Life Insurance For A Mortgage Legal General

What Is Life Insurance Exact Definition Meaning Of Life Insurance

How Do Life Insurance Pay Outs Work Legal General

What Is Limited Pay Life Insurance Paradigm Life Insurance

Guaranteed Issue Life Insurance Policies Fidelity Life

What Is Whole Life Insurance Cost Types Faqs

Types Of Life Insurance Explained Progressive

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

How Much Car Insurance Is Required In Every State Policygenius

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

2022 Final Expense Insurance Guide Costs For Seniors

What Is Life Insurance Exact Definition Meaning Of Life Insurance

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference